Exactly how to Select one of the most Trustworthy Secured Credit Card Singapore for Your Demands

Wiki Article

Exploring Options: Can Former Bankrupts Secure Credit Rating Cards Complying With Discharge?

Browsing the financial landscape post-bankruptcy can be an overwhelming task for people wanting to rebuild their credit scores. One usual inquiry that develops is whether previous bankrupts can effectively acquire charge card after their discharge. The response to this questions entails a multifaceted exploration of various variables, from charge card alternatives tailored to this demographic to the effect of previous financial decisions on future creditworthiness. By comprehending the details of this process, individuals can make informed decisions that may lead the way for a more secure monetary future.Understanding Credit Score Card Options

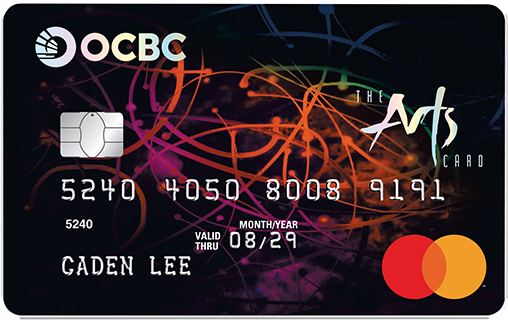

Navigating the world of bank card alternatives requires an eager understanding of the differing attributes and terms offered to consumers. When considering charge card post-bankruptcy, individuals have to meticulously examine their needs and economic situation to select the most suitable choice - secured credit card singapore. Safe charge card, as an example, call for a cash money deposit as security, making them a sensible choice for those looking to restore their debt history. On the various other hand, unsecured charge card do not demand a deposit yet may feature higher rates of interest and charges.In addition, individuals ought to pay very close attention to the interest rate (APR), moratorium, yearly charges, and rewards programs offered by various credit report cards. APR dictates the expense of obtaining if the balance is not paid in complete every month, while the grace duration determines the home window during which one can pay the balance without sustaining interest. Additionally, yearly costs can influence the general price of owning a charge card, so it is important to examine whether the advantages surpass the costs. By thoroughly examining these elements, people can make educated decisions when selecting a charge card that aligns with their financial goals and scenarios.

Aspects Influencing Approval

When applying for credit cards post-bankruptcy, recognizing the factors that influence approval is essential for people seeking to restore their economic standing. Following a personal bankruptcy, debt scores commonly take a hit, making it more challenging to qualify for typical credit score cards. Showing liable financial behavior post-bankruptcy, such as paying bills on time and maintaining credit report use reduced, can likewise favorably influence credit rating card approval.

Secured Vs. Unsecured Cards

Recognizing the distinctions in between secured and unsafe charge card is vital for individuals post-bankruptcy looking for to make educated decisions on restoring their financial health. Protected credit history cards call for a money deposit as collateral, usually equal to the debt limitation prolonged by the provider. This deposit minimizes the threat for the credit rating card business, making it a sensible option for those with a background of personal bankruptcy or bad credit score. Safe cards frequently come with reduced credit line and greater rate of interest prices compared to unsecured cards. On the various other hand, unsecured bank card do not need a cash down payment and are based solely on the cardholder's credit reliability. These cards normally offer greater credit line and reduced rate of interest for people with great credit rating. Nevertheless, post-bankruptcy people may find it testing to get approved for unprotected cards right away after discharge, making secured cards an extra feasible alternative to start restoring credit history. Inevitably, the choice in between secured and unsecured credit scores cards relies on the individual's monetary scenario and credit scores objectives.

Structure Credit Rating Properly

To effectively restore debt post-bankruptcy, establishing a pattern of liable credit usage is essential. In addition, keeping debt card equilibriums reduced loved one to the credit limit can favorably influence debt ratings.Another method for developing debt properly is to keep track of credit score reports regularly. By evaluating debt reports for mistakes or indications of identity theft, individuals can attend to issues quickly and maintain the accuracy of their credit rating. In addition, it is suggested to avoid from opening up several new accounts at the same time, read as this can signal monetary instability to prospective lenders. Instead, focus on progressively branching out charge account and demonstrating regular, liable credit habits over time. By adhering to these practices, people can gradually rebuild their explanation their credit score post-bankruptcy and work towards a healthier monetary future.

Gaining Long-Term Benefits

Having developed a structure of responsible credit score administration post-bankruptcy, individuals can currently focus on leveraging their improved creditworthiness for long-lasting monetary advantages. By regularly making on-time payments, maintaining credit use low, and checking their credit reports for accuracy, previous bankrupts can slowly restore their credit report. As their credit history boost, they may come to be qualified for far better bank card offers with reduced rate of interest and higher credit line.

Gaining lasting take advantage of boosted credit reliability prolongs beyond simply bank card. It opens doors to positive terms on lendings, home mortgages, and insurance premiums. With a strong credit rating, people can negotiate much better passion prices on lendings, potentially conserving hundreds of bucks in interest payments gradually. In addition, a favorable credit scores account can boost job potential customers, as some companies might examine credit rating reports as part of the hiring process.

Final Thought

To conclude, former bankrupt individuals may have problem protecting credit cards following discharge, however there are choices offered to assist reconstruct credit. Understanding the different sorts of bank card, elements affecting authorization, and the relevance of liable credit scores card usage can assist individuals in this circumstance. By picking the right card and using it responsibly, former bankrupts can slowly boost their credit score and gain the lasting advantages of having accessibility to credit rating.

Demonstrating responsible monetary habits post-bankruptcy, such as paying bills on time and keeping credit report usage low, can likewise favorably affect credit scores card approval. Furthermore, keeping credit rating card equilibriums low family member to the credit scores additional resources restriction can positively influence credit report scores. By regularly making on-time settlements, maintaining debt use low, and checking their credit history records for accuracy, previous bankrupts can slowly restore their credit report scores. As their credit score scores raise, they may come to be eligible for much better credit rating card uses with lower rate of interest prices and higher credit score limits.

Comprehending the various types of debt cards, elements influencing approval, and the significance of liable credit scores card use can help individuals in this circumstance. secured credit card singapore.

Report this wiki page